|

3 October 2022, New Zealand – As soaring inflation and the cost of living continue to put pressure on household budgets, homeowners should brace for even more, according to a new Finder poll.

In this month’s Finder RBNZ Official Cash Rate Survey, 14 experts and economists weighed in on future official cash rate (OCR) moves and other issues relating to the state of New Zealand’s economy.

All panellists (100%, 14/14) are confident the OCR will change yet again on Wednesday by 50 basis points – bringing the OCR to 3.50% in October.

The majority of experts (75%, 9/12) expect the cash rate to peak between 4% and 4.5%.

Taylor Blackburn, personal finance specialist at Finder, said money was already tight for many Kiwis.

“Kiwis are feeling the crunch as the cost of groceries, petrol, and travel continue to skyrocket.

“Another lifting of the cash rate – the fifth consecutive hike of 50 basis points – will be especially tough for homeowners who are already cutting it fine,” Blackburn said.

Brad Olsen from Infometrics cited inflation as a key driver of the anticipated rate rise.

"Inflationary pressures remain high, and recent data (aside from fuel prices) doesn't show any trend of inflation letting up yet. The falling exchange rate will make the job of getting inflation down even harder.

“We expect more raises to come until inflation is demonstrably in decline," Olsen said.

David Shaw from REINZ agreed.

"Inflation is high, unemployment low, economy stimulated. If inflation is going to be curtailed, OCR hikes seem to be the way RBNZ manages that," Shaw said.

A recession is likely before 2025

The majority of experts who weighed in* (73%, 8/11) expect New Zealand to go into a recession in the next three years.

Just over half (55%, 6/11) believe this recession will occur sometime next year.

Blackburn said now is the time to set a budget.

“Sticking to a budget and cutting out non-essentials is the best way to make sure you have enough money to get by.

“Budgeting gives you financial freedom because it lets you allocate money towards ‘fun’ expenses, without feeling guilty or that you’re putting your financial future on the line,” Blackburn said.

Jarrod Kerr from Kiwibank said the country was facing a significant slowdown and the risk of a mild recession is growing with every RBNZ rate hike.

“We hope the economy can adapt and work through the challenging environment," Kerr said.

Building greener houses good for economy, but won’t help affordability

REINZ data shows median house prices, excluding Auckland, have increased by 4.5% in July 2022 compared to July 2021.

Almost 2 in 3 experts (63%, 5/8) believe price increases in regional areas are being driven up by people in the cities moving to more affordable areas.

Dr Oliver Hartwich from The New Zealand Initiative noted, "People respond to incentives, and the differential between urban and rural areas could widen quite a bit over the coming months."

A report by Business and Economic Research Limited recently revealed that building new houses and offices with reduced carbon emissions would add $147 billion and 46,000 new jobs to the economy by 2050.

While two-thirds of experts (67%, 6/9) say that changing the building code to ensure more low emission residential construction is a good way to grow the economy, the majority (78%, 7/9) also believe this will make housing more expensive in New Zealand.

Immigration key to economic relief

In 2021 the government offered 165,000 one-off resident visas to attract skilled migration (compared to only 43,527 in 2020).

Almost 4 in 5 experts (78%, 7/9) say the government should increase the immigration cap further to stimulate the economy.

Alfred Guender from the University Of Canterbury said skilled immigrants should always be welcome.

“They contribute to prosperity and the well-being of New Zealanders," Guender said.

Dr Oliver Hartwich from The New Zealand Initiative said the country needs migrants.

“We have skills shortages in practically every industry.

“It should be a no-brainer to increase the immigration cap, and even then it will be difficult to attract the migrants we need because there is a global competition for talent, and New Zealand may no longer be the most appealing destination," Dr Hartwich said.

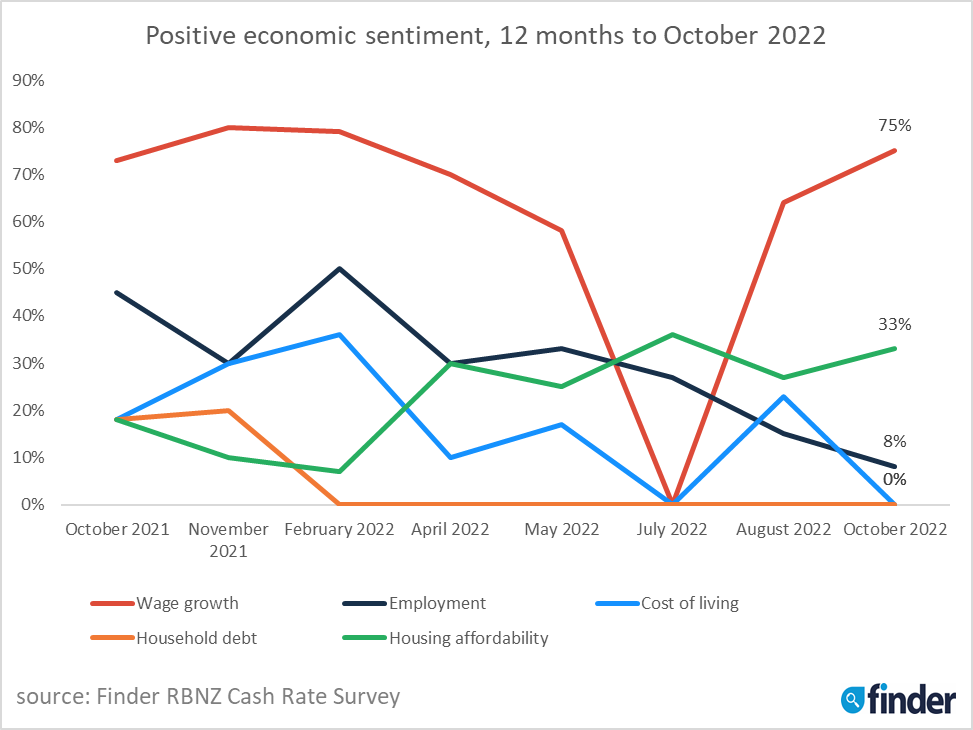

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt over the next 6 months.

While negativity towards cost of living remains high (83%), positivity towards wage growth has jumped from 64% in August, to 75% in October, after plummeting to 0% in July.

Positivity towards household debt remains at 0%, where it has been since February 2022.

*Experts are not required to answer every question in the survey

Here’s what our experts had to say:

Alfred Guender, University Of Canterbury (Increase): "The tightening cycle will continue in NZ especially now that the Federal Reserve hiked the Federal Funds rate again by 75 basis points last week. Otherwise the NZ Dollar would slide further against the US Dollar, thereby increasing imported inflation."

Brad Olsen, Infometrics (Increase): "Inflationary pressures remain high, and recent data (aside from fuel prices) doesn't show any trend of inflation letting up yet. The falling exchange rate will make the job of getting inflation down even harder. We expect more raises to come until inflation is demonstrably in decline."

Ashley Church, ashleychurch.com (Increase): "Inflation is not yet under control and Orr has indicated that he intends to continue with his tightening strategy until it is."

Mark Holmes, University of Waikato (Increase): "A further increase is warranted. There needs to be strong evidence that both inflation and expected inflation are moving back down towards the Reserve Bank target."

Robin Clements, UBS NZ Ltd (Increase): "CPI inflation above target and labour market above MSE."

Michael Gordon, Westpac (Increase): "A sustained period of higher interest rates will be needed to bring inflation into check."

Donal Curtin, Economics New Zealand Ltd (Increase): "Inflation, and notably non-tradable (domestically generated) inflation is still way above its target range and needs to be brought down."

David Shaw, REINZ (Increase): "Inflation is high, unemployment low, economy stimulated. If inflation is going to be curtailed, OCR hikes seem to be the way RBNZ manages that."

Debbie Roberts, Property Apprentice (Increase): "All indications are that inflation is still an issue that could be challenging to get back under control, so I believe that the RBNZ will continue with a relatively aggressive path of increasing the OCR until they see evidence of it working."

Jarrod Kerr, Kiwibank (Increase): "The RBNZ is determined to pull demand down to better meet capacity constrained supply. Or put simply, they must hammer inflation back down towards 2%."

Michael Reddell, Croaking Cassandra economic commentary blog (Increase): "There is a fair amount of momentum to the Bank's actions and the October review comes before the CPI, so there probably isn't anything to change their plans. By the end of the year, it would be prudent to wait and see the lags play out."

Sharon Zollner, ANZ (Increase): "Core inflation pressures are likely to prove stickier than anticipated."

Dr Oliver Hartwich, The New Zealand Initiative (Increase): "Inflation remains high with signs that inflation expectations are becoming persistent. The stronger than expected GDP figures will also add weight to the case for an OCR increase in October. Finally, the RBNZ has recently sent some more hawkish signals, so we can take a further OCR increase almost as a given."

Kelvin Davidson, CoreLogic (Increase): "Inflation is still a problem and the mandate to keep raising the OCR is clear. Arguably more uncertainty would be created if they didn't raise by 50bps."

|