A spectacular collapse in sentiment in the residential construction industry is one of the standouts in another gloomy ANZ Business Outlook Survey (ANZBO).

In speaking to the July ANZBO survey results, ANZ's NZ chief economist Sharon Zollner said sentiment in the residential construction sector had undergone a "truly spectacular crash to fresh lows".

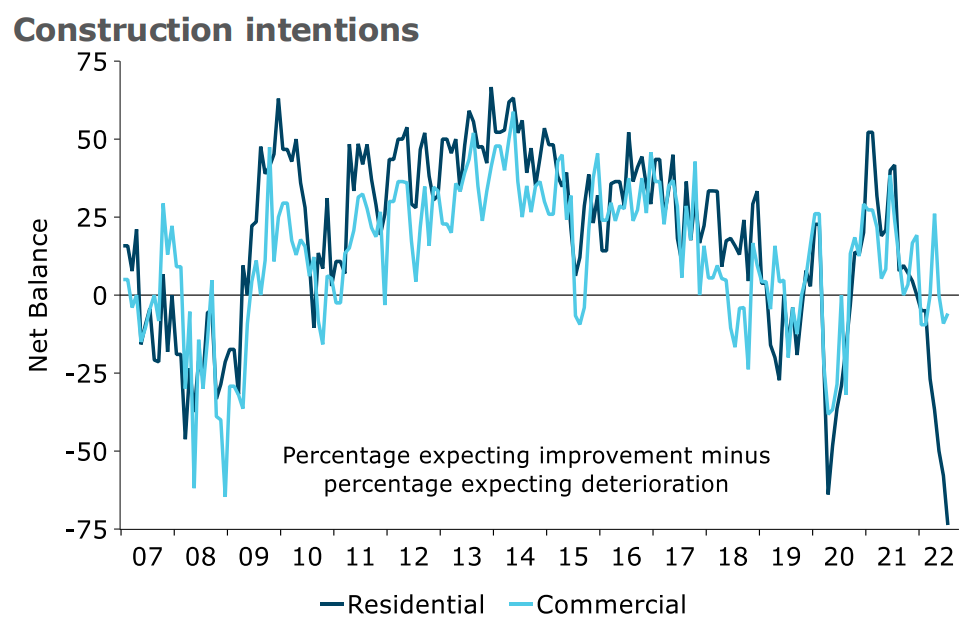

"The outlook for house-building has hit a brick wall in that there was a sharp fall in residential construction intentions. Note the fall in early 2020 [as seen in graph below] was due to lockdown – it’s difficult to imagine what would lead to such a rapid bounce this time.

"Housing consents are now dropping, as foretold by the ANZBO data three months ago. Broader 'dwelling' consents (including apartments etc) are holding up better for now, but don’t tend to diverge from housing consents for long," Zollner said.

According to Statistics New Zealand the seasonally adjusted number of new stand-alone houses consented fell 1.4% in May, after falling 5.9% in April 2022. The seasonally adjusted number of new dwellings (including townhouses, flats, units, apartments and retirement village units) consented fell 0.5%, after falling 8.6% in April 2022

"The ANZBO data suggests consents may have a lot further to fall yet," Zollner said.

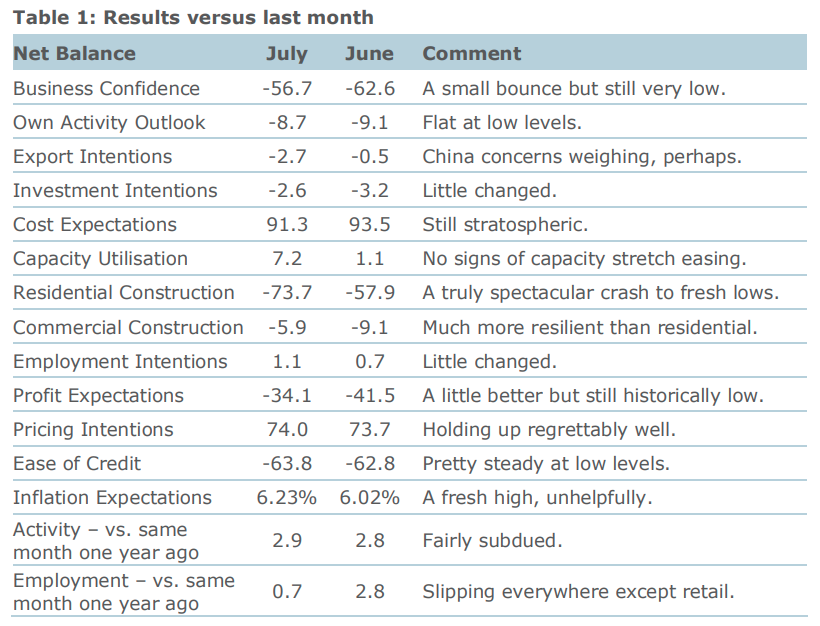

Among other features in the latest survey, inflation and pricing pressures remained intense. Year-out inflation expectations have actually hit a new high of 6.23%.

Business confidence bounced 6 points in July to -56.7, while expected own activity was little changed at -8.7.

"Most activity indicators were little changed in July although responses received later in the month were weaker, on the whole," Zollner said.

"Economy-wide inflation pressures remain intense, as captured by inflation expectations, cost expectations, and pricing intentions. The rate of increase in costs appears to have stabilised, but is still far too high.

"The agriculture sector is expecting the highest cost inflation by far, but has little pricing power, while the retail sector has the highest pricing intentions – and their pricing decisions have the largest direct impact on the CPI.

"The outlook for wage growth is a crucial determinant of the likely path of non-tradable inflation. The RBNZ can take some comfort that at least the data isn’t showing a strong upward trend in expected wage growth.

"Thirty percent of the sample were received following the RBNZ’s (well-anticipated) 50bp OCR hike and Statistics NZ’s staggering CPI print for the June quarter. It is notable that employment and investment intentions dropped sharply compared to the early crowd.

"In both cases, that’s an unusually large gap. Perhaps it’s a sign that interest rates have hit some kind of pain threshold."

Zollner said New Zealand businesses are well aware that the Reserve Bank is on a mission to reduce customer demand for their wares in order to reduce inflation.

"No wonder they’re feeling apprehensive.

"While they wait for that hammer to fall, supply-side factors continue to cause headaches, including ever-higher costs, and, as we saw from the quarterly 'biggest problems' question last month, a severe lack of labour.

"In theory, there will be a sweet spot at some point in the future where easing demand meets easier supply conditions. In practice, one suspects that that moment may prove fleeting."

Business confidence - General

Select chart tabs

79 Comments

Yes and no. In the immediate future its all about affordability for homeowners and expectations of negative carry and reducing prices for investors. This is what's currently driving the price trend.

For the longer term though the reduced construction means we are steps further back improving the quality of housing stock. So yes, when rates eventually fall again the poorer stock is still likely to be costly (despite being cold, moldy and damp) purely due to the lack of supply of new homes.

The reason construction is slowing, is because developers can no longer pass on the inflation costs via higher and higher prices.

As you say household affordability is maxed out, even before higher rates.

Incomes are not rising in line with inflation. Certainly not land prices.

Cost of building won't come down anytime soon. And increased migration will maybe kick up demand, but who you importing? Low skilled labourers? That will just surpress incomes further (and degrade everyones quality of life as we already have too many people for not enough services.

And no one who we need to do manual jobs can afford to live here as it is.

Anything is possible, but I think the only thing that can move now is land prices.

Last two paragraphs

https://www.oneroof.co.nz/news/tony-alexander-housing-market-is-still-g…

A backlog of buyers? How is this measured anyway? There's this idea there are thousands of FHB on the sidelines, yet RBNZ C31 suggests 30k+ FHB purchases are made each year. When you consider 20 - 30 years ago there were less than 60k live births per year, and assume most FHB are couples, then 30k+ purchases is enough to cover 60k people. I assume migrants are measured as FHB on RBNZ lending stats?

https://www.stats.govt.nz/information-releases/births-and-deaths-year-e…

House prices will bounce, sure. The question is how soon, and how far to go until we reach the floor. Could be another double digit fall from here quite easily.

I wouldn't be putting money in at the moment, personally. Plenty of fat in land prices still to be trimmed.

There’s not going to be a bounce…this will be u-shaped. Less new construction may make for a more shallow u, although many of those construction related workers who loose their jobs as a result may vote with their feet and head o/s, reducing demand. Many factors to play out but bottom line is prices still too high to be sustainable in a normalised market (no QE or artificially low interest rates etc)

Its long overdue so well needed

NZ (and the world) has gone way past when it should have happened so it may be a much bigger dip than average... but vital to remember that the world economy doesnt stop in a recession it just shifts a bit, and opportunities to get ahead will always abound - recession or not.

And in the medium to long term we should end up with cheaper house prices, stronger businesses and a better balanced economy :) With any luck the NZ government will get replaced by a better team too.

Aloha. You mean 7-houses-luxon and his merry band of avid house investors?

At least they are honest about wanting to lower taxes for the rich and trying to repump the house market.

I am not sure what else they have in mind though. I am not 100% certain but i think they are anti climate change too?

And whilst i am not hard either way on pro life (though i would probably support whatever majority of women want), i believe that 7 house Luxon feel strongly about it but promises not to actually try to do anything about it. In case people dont vote him in and he cant try to reinflate house prices.

Now... were he to come out with a decent strategy to grow tech business, a proper immigration policy that benefits all NZ'ers and balances immigration needs with infrastructure needs, that was climate friendly, made houses affordable for kids and teachers etc and actually would attract more healthcare workers, scientists etc. I (and i am sure many other hard working, successful, business oriented kiwis with families) will be all all ears.

How can you blame them? The average Kiwi will never have a hope of owning their own home in our economy. Employers are complaining that they cannot afford to raise wages any higher. They need to realize that a large proportion of those wages are going directly to prop up the crazy house prices. Their calls for immigrants is at best a short term sugar rush because the pressure on house prices and infrastructure costs will only increase as a result. => higher wage pressure demands and population loss. The only way out of the mess it to freeze immigration and crash house prices. Not very likely that any political party will go very far down that track, especially after the inevitable change of government next election. Accordingly the only rational option left for young Kiwis is to leave New Zealand. Far better than becoming bitter and twisted remaining and hoping things will somehow change. The past decades indicate that this is highly unlikely.

Exactly - we're foolishly attempting to sustain unsustainably high house prices. And you hear people say 'things will get really bad if house prices crash'....no they're already bad now..

Remember when Cindy promised both high house prices and affordable housing at the same time?

I think the sheeple kind of believed it.

Most business groups on the media are brushing this trend off as delayed OE. The focus is starkly on ensuring there are enough migrants to replace outgoing skilled Kiwis in order to keep the sweatshops running.

Some are making this whole argument so ridiculous by arguing the median wage threshold is too high and then complaining that they continue to lose workers to other sectors or countries that pay more.

Yes, I agree Te Kooti, looks like hard recession ahead. It would not have been necessary, a soft landing could have been engineered with soft, slow and considered OCR hikes to say 1% p.a.

"Perhaps it’s a sign that interest rates have hit some kind of pain threshold" says ANZ's Zollner, per the article. Yes, they have hit a pain threshold like a dentist hitting a nerve.

I will agree with one part, they could have started with " slow and considered OCR hikes" about 18 months earlier than they did, then the mess wouldnt have been as big and we wouldnt be raising by .50 every month.

Interest rates are still net negative, no chance of leaving it at an emergency rate of 1% while inflation is 7-10%. unless you want to be Zimbabwe.

Many did their maths on high selling price, so went out to pay premium on top of premium ( any amount) as a result the cost of the entire project be it one house or more shot up and now with market falling are screwed as will be lucky if are able to recover their cost or get away with minimum loss.

Greed blinds logic.

Many did their maths on high selling price, so went out to pay premium on top of premium ( any amount) as a result the cost of the entire project be it one house or more shot up and now with market falling are screwed as will be lucky if are able to recover their cost or get away with minimum loss.

Of course they did. Basic ROI for their efforts.

Germany is facing serious economic turmoil with the ongoing energy scarcity and a central bank that will not tighten monetary policy despite skyrocketing inflation. Yet somehow their businesses are more optimistic than ours.

I think a good amount of this gloomy outlook is the usual bitching and moaning from our businesses to force the government's hand on policies such as immigration etc.

I'm actually convinced there's a level of societal epigenetics involved. Our ancestors all left their counties of birth from discontent, in search of greener pastures. So our gene pool is over represented with dissatisfaction and itchy feet, which is easily exploitable by news media.

Well Germany is hugely different. Energy prices are probably the biggest problem, while food prices are extremely low compared to NZ--they could stand to increase substantially. People grumble there but in reality the level of security people have against inflation is much better than here. As the euro drops their exports will do well, as long as the fuel problem does not get out of hand.

Advisor, you state that "Germany is facing serious economic turmoil with the ongoing energy scarcity and a central bank that will not tighten monetary policy despite skyrocketing inflation. Yet somehow their businesses are more optimistic than ours."

Germany's businesses are rightly more optimistic than ours (despite a war occurring nearby), because the ECB has set a moderate interest rate of 0.5%, unlike ours which is a crippling 2.5%. As a result, Germany is not currently going into economic depression, but we are.

I predicted this early-mid last year.

By early 2023 unemployment in residential construction and encompassing many related sectors - builders, contractors, tradies, surveyors, suppliers, engineers, architects, planners, real estate agents etc - will have started to soar. This will reverberate around the economy, creating a negative multiplier effect - less money spent on new vehicles, in hospo, retail etc.

Overall unemployment could well be at least 5-6% by autumn 2023, and this together with significant falls in inflation will allow the RBNZ to start cutting the OCR.

ACT were opposed to apartments being built in Epsom, and were opposed to apartment dwellers being allowed to go to their local public school. They are the opposite of free market if it does not suit their supporters.

They probably won’t put that on their website, it’s a special secret policy that all of Epsom know about.

Are we talking ourselves into a recession ?

https://www.rnz.co.nz/news/business/471775/business-confidence-in-a-les…

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.